Economic Scan - Newfoundland and Labrador: 2024

Demographics

Highlights

- The proportion of seniors aged 65+ is projected to increase from 24.4% in 2023 to 29.7% in 2033.

- In 2023, individuals aged 55 and over accounted for 46.2% of the working-age population. This is projected to reach 48.8% in 2033.

- The proportion of youth (15-29) is projected to decline from 16.0% in 2023 to 15.3% in 2033.

- Most youth work in environments that prevent teleworking, led by retail trade as well as accommodation and food services.

Average age of the non-Indigenous population in the province is 45.7 versus 39.1 in the Indigenous population (2021 Census).

The Indigenous population represents 9.3% of the total provincial population (2021 Census) and faces more challenging labour market conditions. This includes a higher unemployment rate and lower participation rate when compared to the non-Indigenous population.

Recent immigrants (those arriving between 2016 and 2021) accounted for 29.9% of Newfoundland and Labrador’s immigrant population in 2021. The pace of new arrivals has increased significantly in recent years, particularly as the province has placed considerable emphasis on increasing immigration levels to fill labour market gaps. Immigrants have a higher participation rate and a lower unemployment rate when compared to people born in Canada.

99.4% of Newfoundlanders and Labradorians identified English as their first official language (2021 Census), while 0.5% identified the province's other official language, French. Only 0.1% identified a first language that was neither English nor French.

According to the 2022 Canadian Survey on Disability, 30.9% of the provincial population aged 15 and over were persons with disabilities, an increase of 7.3 percentage points compared to the 2017 survey. In comparison, Canada's disability rate increased by 4.7 percentage points to 27.0%. The stronger provincial increase and higher than average disability rate can be tied to an aging population, as disability rates increase with age. Newfoundland and Labrador have the highest median age in Canada (48.0 years).

Labour Market Conditions

In 2023...

Employment increased moderately (1.8%)

Unemployment declined significantly (-11.5%)

Participation rate declined moderately (58.4% to 57.8%)

Employment rate was stable (51.9% to 52.0%)

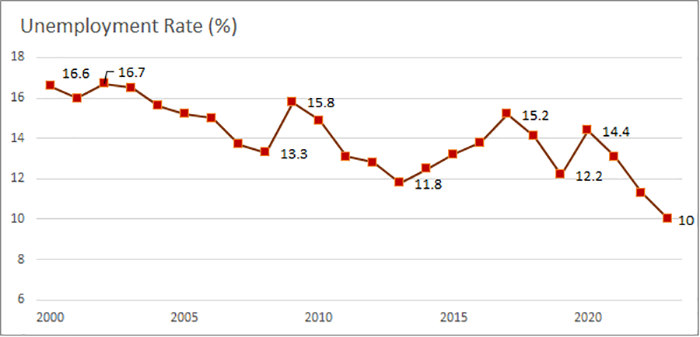

Newfoundland and Labrador's Unemployment Rate

Show data table: Provincial Monthly Unemployment Rate

| Year | Unemployment Rate (%) |

|---|---|

| 2000 | 16.6 |

| 2001 | 16.0 |

| 2002 | 16.7 |

| 2003 | 16.5 |

| 2004 | 15.6 |

| 2005 | 15.2 |

| 2006 | 15.0 |

| 2007 | 13.7 |

| 2008 | 13.3 |

| 2009 | 15.8 |

| 2010 | 14.9 |

| 2011 | 13.1 |

| 2012 | 12.8 |

| 2013 | 11.8 |

| 2014 | 12.5 |

| 2015 | 13.2 |

| 2016 | 13.8 |

| 2017 | 15.2 |

| 2018 | 14.1 |

| 2019 | 12.2 |

| 2020 | 14.4 |

| 2021 | 13.1 |

| 2022 | 11.3 |

| 2023 | 10.0 |

- Employment increased for the third consecutive year, adding 4,200 jobs over the previous year, and reaching its highest level since 2015. This growth was mainly in full-time positions. The unemployment rate fell to 10.0%, the lowest on record going back to 1976. Compared to the pre-pandemic conditions of 2019, there were 6,800 more jobs in 2023. However, the labour force has not grown to the same extent (+1,100).

- Two-thirds of the annual employment gain was in the services-producing sector. Health care and social assistance reached a new high, driven by the demands of an aging population. The goods-producing sector produced mixed results. While fishing, hunting, and trapping fell to its lowest level on record, mining, quarrying, and oil and gas extraction hit a new high, mainly due to strength in the mining sector.

Economic Conditions

Newfoundland and Labrador's Economic Drivers in 2023

Population Growth

Retail Sales

Tourism

Show data table: Provincial Monthly Employment and Unemployment Rate

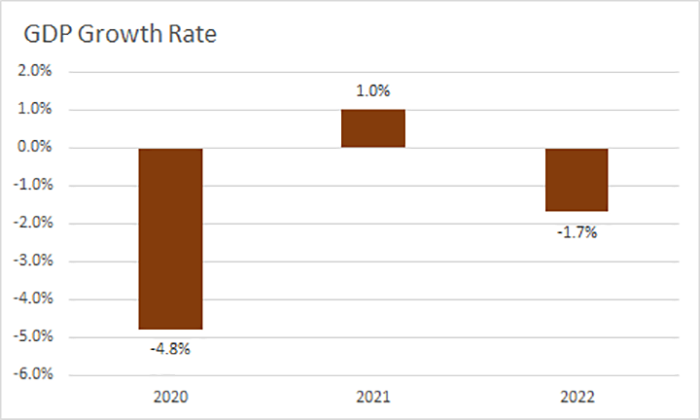

| Year | GDP growth rate |

|---|---|

| 2020 | -4.8% |

| 2021 | 1.0% |

| 2022 | -1.7% |

- The province’s population increased by 1.3% in 2023, reaching its highest level since 1998. Between July 1, 2022 and July 1, 2023, net international in-migration reached a record yearly high (+9,040), while net interprovincial migration was also positive (+542). These changes outweighed losses resulting from deaths exceeding births. This was the first year since 1992 when there was an annual increase in the population aged 15 to 44 years (+4,544). However, it should be noted that the group aged 65 years and older had the fastest growth rate (+3.1%), increasing by 3,954.

- Retail sales reached a record high in 2023, rising by 1.8% over the previous year. Household income increased by 4.4%, driven by wage growth. Sales by motor vehicle and parts dealers (+10.5%) led the increase in spending.

- Tourism spending by non-residents rose (+12%) in 2023. However, it remained below pre-pandemic levels. Non-resident visitations increased by 13% over 2022 levels. Growth was broad across the sector, with air passengers (+16%), non-resident automobile visitors (+3%), convention delegates (+7%), cruise ship visitors (+59%), and accommodation room nights sold (+22%) all contributing.

Risks to the Newfoundland and Labrador Economy in 2024

- Global economic conditions are forecasted to improve in 2024. This should result in higher oil and mineral production and prices. In turn, the province is expected to lead the country with real GDP growth of 5.1%. However, such forecasts are vulnerable to the growth prospects of key markets such as China, where downside risk exists as the country did not meet expectations for 2023. In addition, another risk element is from conflicts in the Middle East and Ukraine, as such events can be unpredictable and negatively affect the global economy.

- Inflation has come down from peak highs, suggesting a potential lowering of interest rates over time. However, it is difficult to forecast if and when such changes will occur and how far interest rate cuts may go. If rates remain elevated for an extended period, this can result in lower-than-expected economic growth due to reduced business investment and consumer spending, higher levels of consumer and business debt, and lower employment.

Provincial Issues

- The deficit for 2023-24 was expected to be $160M but ended the year at $433M, pushing a return to balance to the 2025-26 fiscal year instead of the current period. The deficit for 2024-25 is forecasted to be $152M. Net-debt for 2024-25 is expected to rise by $16.2B to $17.8B. The provincial government plans to borrow $2.8B for 2024-25, up from $2.2B the year before. Debt relative to the size of the economy has risen over the past two years and is the highest in the country. High debt levels can limit the amount of money available to spend on health care, infrastructure, education, and other services. Strong growth in health spending is expected for 2024-25, rising by $500M and representing almost 40% of the province's budget.

- In recent years, elevated interest rates and higher costs for building materials and labour have all played a role in limiting housing starts. Over the same period, the province's population has notably risen. As a result, housing shortages have been evident. Vacancy rates have fallen well below 2%. As interest rates fall, housing starts are expected to increase by 33% in 2024 to 1,300, with another 19.5% increase in 2025. The provincial government plans to spend money in new provincial housing units in various areas, as well as invest in repairs, maintenance, and renovations of its existing stock.

- Newfoundland and Labrador has the oldest population in the country and is aging faster than any other province. Furthermore, outmigration among younger groups has been a long-term issue, particularly in rural areas. International immigration levels have increased and need to remain elevated to help address labour shortages.

Industry Trends

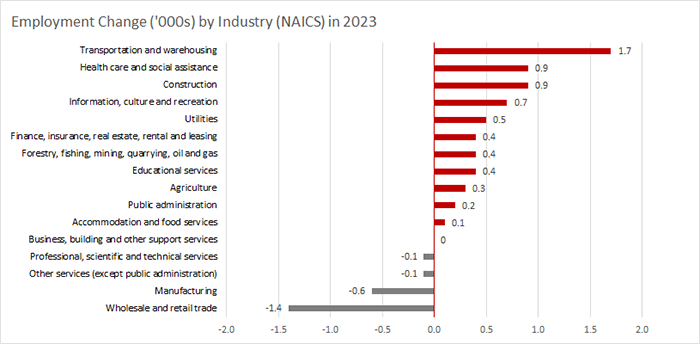

Show data table

| Industry (NAICS) | Employment Change ('000s) |

|---|---|

| Transportation and warehousing | 1.7 |

| Construction | 0.9 |

| Health care and social assistance | 0.9 |

| Information, culture and recreation | 0.7 |

| Utilities | 0.5 |

| Finance, insurance, real estate, rental and leasing | 0.4 |

| Educational services | 0.4 |

| Forestry, fishing, mining, quarrying, oil and gas | 0.4 |

| Agriculture | 0.3 |

| Public administration | 0.2 |

| Accommodation and food services | 0.1 |

| Business, building and other support services | 0.0 |

| Other services (except public administration) | -0.1 |

| Professional, scientific and technical services | -0.1 |

| Manufacturing | -0.6 |

| Wholesale and retail trade | -1.4 |

- Following a steep decline to its lowest employment level on record in 2021, transportation and warehousing has strongly rebounded in the past two years, reaching a record high. Strong increases in both air and truck transportation have been behind these gains.

- Accommodation and food services has struggled to rebound to pre-pandemic employment levels. Higher food prices, lower discretionary spending among consumers, and labour shortages have all been challenges.

- Health care and social assistance reached a record employment high for the third consecutive year in 2023. An aging population has been a key contributor to increased health care demands. Despite this record high employment, shortages persist throughout health care in this province and the country.

- While overall employment increased in 2023, wholesale and retail trade declined. Despite the addition of jobs in the provincial economy, higher inflation combined with a lack of labour availability had a negative impact on the industry.

Regional Economic Conditions

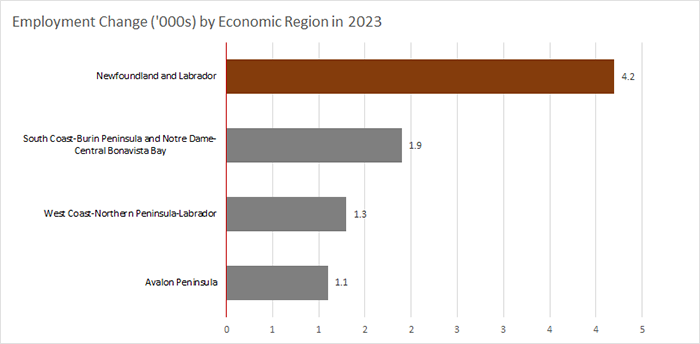

- While employment in the Avalon Peninsula region reached its highest level since 2013, employment growth over the past year was relatively weak, and full-time employment declined slightly. New highs were reached in transportation and warehousing as well as health care and social assistance, offsetting a loss in wholesale and retail trade.

- Employment increased in the South Coast-Burin Peninsula and Notre Dame-Central-Bonavista Bay region, reaching its highest level since 2018. The gain was mainly in the services-producing sector, particularly in health and social assistance.

- In the West Coast-Northern Peninsula-Labrador region, gains in the goods-producing sector outweighed losses in service-producing industries. Forestry, fishing, mining and oil and gas reached a record high. However, accommodation and food services fell to its lowest level going back to 2006.

Show data table

| Region | Employment Change ('000s) |

|---|---|

| Newfoundland and Labrador | 4.2 |

| South Coast-Burin Peninsula-Notre Dame-Central Bonavista Bay | 1.9 |

| West Coast-Northern Peninsula-Labrador | 1.3 |

| Avalon Peninsula | 1.1 |

Download the PDF version (552 KB) of this content.

- Date modified: